COP26: Massive funding proposed by new alliance to help emerging economies make green transition

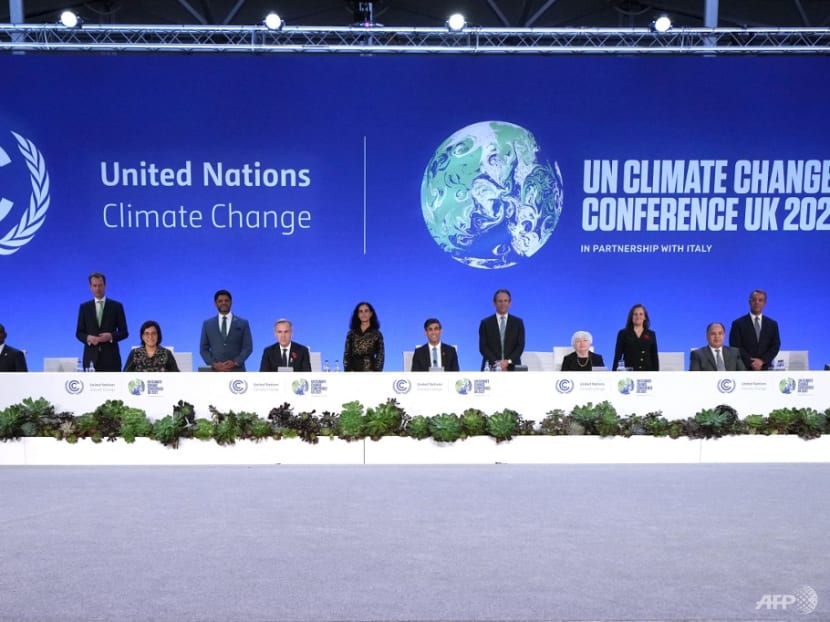

World finance ministers at COP26 in Glasgow, Scotland on Nov 3, 2021. (Photo: Christopher Furlong/Getty Images Europe/POOL/AFP)

GLASGOW: A new alliance aims to reach one billion people with renewable energy and divert billions of tonnes of carbon emissions with hefty investments in developing and emerging countries.

The Global Energy Alliance for People and Planet (GEAPP) aims to unlock US$100 billion in public and private funding to expand clean energy infrastructure and create new jobs in places that have been left behind or need more assistance to make a green transition

It is an initiative supported by the Indonesian government and there is an ambition among the alliance’s leadership to further involve other nations in Southeast Asia, including the Philippines, Myanmar and Vietnam.

“The initiative brings together the critical stakeholders that must align and co-create a sustainable path for our nations and for our grandchildren,” Indonesian President Joko Widodo said, in endorsing the alliance.

A US$10 billion package has been made available initially, from a variety of philanthropic partners, multilateral development banks, development financial institutions and national governments.

It comes as the focus of global climate change talks at COP26 in Glasgow turned to mobilising the vast amount of finance needed to drive the world’s net zero ambitions.

FAST-TRACKING THE GREEN TRANSITION

It is estimated that trillions of dollars will be needed, much of it by poorer nations, if the planet is to avoid catastrophic heat increases and the impacts that will result, including more intense weather events and rising sea levels.

Much scrutiny and negotiating at the conference is centred on the US$100 billion promised by developed nations on an annual basis to help poorer countries meet the challenges of climate change. Since that pledge in Paris in 2015, that amount has consistently been under-delivered.

Finance ministers at COP26 have been discussing how to use public funds to leverage enormous amounts of private finance that could prove key to fast-tracking the green transition.

A coalition of the world’s biggest investors, banks and insurers aligned on Wednesday (Nov 3) under the Glasgow Financial Alliance for Net Zero, to ensure that their US$130 trillion in capital is used to target net zero emissions by 2050, putting climate change at the forefront of global financial decision making.

“We now have the essential plumbing in place to move climate change from the fringes to the forefront of finance so that every financial decision takes climate change into account,” the leader of the group, Mark Carney said in a statement.

OPPOSITION FROM ACTIVISTS

It is a plan that was quickly condemned by environmental activists, including Greta Thunberg, who took aim at the industry’s reliance on carbon offsets and perceived corporate greenwashing and launched demonstrations through Glasgow streets.

Meantime, the GEAPP, which includes the Rockefeller Foundation, will aim to use initial grants to kickstart projects that can eventually be scaled up to a commercial level, drawing in even more funds.

“This meeting and the politics of it simply have to generate a meaningful growth story for populations consistently left behind. We think we can make a difference,” Dr Rajiv Shah, the president of the foundation, told CNA in Glasgow.

“We’re putting in US$500 million, we’ve raised a US$10 billion platform and the goal is to use that in catalytic ways to unlock even more commercial resources to scale this to one billion people.”

The alliance wants to de-risk investments in countries that may not normally attract the types of investments that they need in the face of the climate challenge.

Ashvin Dayal, the CEO of GEAPP said that there is great potential to remove carbon and improve lives in large emerging economies.

“Our focus has been on underserved or unserved communities so we’ve done a lot of work in places like India, Myanmar, sub-Saharan Africa and looking at how we get distributed renewables to address the last mile electrification problem - and that’s a big problem.”

He said that the highest levels of political commitment will be required from partnering governments to give impetus to the investments, which will target policy and regulation development, technical support, de-risking and getting projects to the level where they can be expanded to impact large populations.

“Markets like Indonesia, the Philippines or Vietnam are countries with electricity access numbers that are very high. But when you look at the quality of access and the energy mix there are some real issues there,” Dayal said.

“There’s a massive need, if we can figure out how to transition thousands of mini diesel grids, for example, bring in reliable renewables and accelerate the coal decommissioning process,” he said.

The Asian Infrastructure Investment Bank (AIIB) is also hoping to leverage more private finance as it ups its own climate finance targets, now about US$50 billion by 2030. Fifty per cent of the China-based bank’s projects will be climate finance by 2025 and Singapore is central to its investment ambitions in Southeast Asia.

AIIB’s vice president of Policy & Strategy, Danny Alexander, told CNA that the bank will devote resources to climate change mitigation, renewable energy and other such projects that help reduce carbon emissions.

But it also wants to help shield and prepare countries in Asia from the impacts of climate change.

“In an Asian context, adaptation finance is really critical: finance that helps to protect people against the consequences of the climate change story that we’ve already written is very important,” he said at COP26.

“What we want to say is that in order for this agenda to be effective, we need to really understand what low- and middle-income countries in Asia and beyond really need. And that’s about finance, capacity and understanding that the challenges are very different in different parts of the world.

“There are still 146 million people in Asia that don't have access to electricity at all. You’ve got to understand the different contexts and those voices need to be heard very strongly.”